The 2022/2023 Federal Budget was released last night the 29th of March 2022 which marks the next stage in leading Australia’s strong economy into the future. There has been a strong focus to encourage economic recovery, improve equity and modernise and streamline Australia’s regulations and tax system. Client Manager, Bianca Jaensch, clearly outlines the spending initiatives announced by the Government in Tuesday night’s Budget announcement.

The key tax proposals in the Federal Budget released are summarised below:

PERSONAL TAXATION:

LMITO – Low and middle income tax offset

- The low and middle income tax offset (LMITO) will be increased for the 2021-2022 income year, eligible individuals receiving between $48,000 – $90,000 (phasing out up to $126,000) will receive a benefit of $1,500 instead of $1,080.

- Individuals earning up to $48,000 will receive the $420 one-off tax offset on top of the existing $255 LMITO benefit

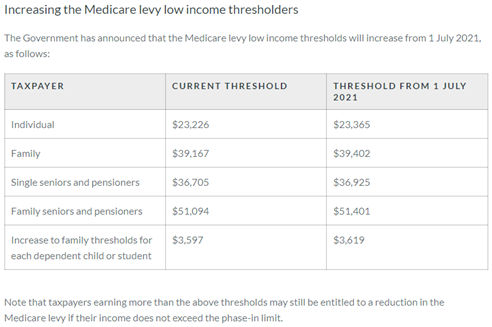

Medicare Levy low-income thresholds increased

- Starting from 1 July 2021, the Medicare levy low-income thresholds have increased, please see the below table:

COVID-19 Test expenses

- Costs of taking COVID-19 tests including polymerase chain reaction test (PCR) and rapid antigen test (RATS) to attend your place of work have been made tax deductible for individuals from 1 July 2021.

- For business, FBT will not be incurred by businesses where COVID-19 tests are provided to employees.

Temporary reduction in fuel excise

- From the 30th of March 2022, the Government intends to streamline the administration of fuel excise that will apply to petrol and diesel by 50% for a period of six months. This measure will aim to cut petrol and diesel prices from 44.2 cents per litre to 22.1 cents.

One-off $250 cost of living payment

- There will be a one-off $250 living payment that will be released in April 2022 for eligible pensioners welfare recipients, veterans, and eligible concessional card holders.

- The $250 will be tax-exempt and will not count as income support.

- You can only receive one economic support payment, even if they are eligible under two or more of the eligible categories

Eligible Categories Include:

- Age Pension

- Disability Support Pension

- Parenting Payment

- Carer Payment or Carer Allowance

- Jobseeker Payment

- Youth Allowance

- Austudy and Abstudy Living Allowance

- Double Orphan Pension

- Special Benefit

- Farm Household Allowance

- Pensioner Concession Card

- Commonwealth Seniors Health Cardholders

- Eligible Veteran Affairs and Veteran Gold cardholders.

BUSINESS TAXATION

Deduction boosts for small business skills and training, digital adoption

- There will be two support measures for small businesses (aggregated turnover less than $50 million) on external training courses and digital technology.

External Training

- Eligible small businesses will be able to deduct an additional 20% of expenditure incurred on external training courses provided to its employees.

- The training courses must be within Australia or online and delivered by entities that are registered in Australia.

- Exclusions apply for in-house or on-the-job training.

- The boost will apply to eligible expenditure incurred from 29 March 2022 – 30 June 2024

Digital Technology

- Eligible small businesses will be able to deduct an additional 20% of the costs incurred that supports its digital adoption. These include portable payment devices, cyber security systems or subscriptions to cloud based services.

- An annual cap will apply for each qualifying income year so expenditure up to $100,000 will be eligible for the boost.

- The boost will apply to eligible expenditure incurred from 29 March 2022 – 30 June 2023.

Superannuation Pension Drawdowns

- A temporary 50% reduction in minimum annual payments for superannuation pensions and annuities will be extended and will end 30 June 2023 given the ongoing volatility which will allow retirees to avoid selling assets in order to satisfy the minimum drawdown requirements.

- The reduction in minimum payment amounts is expected to apply to account-based, allocated and market linked pensions. Minimum payments will be determined by the age of the beneficiary and the value of the account balance as at 1 July each year.

- The 50% reduction in the minimum pension payments are not compulsory. A pensioner can continue to draw a pension at the full minimum drawdown rate, subject to the 10% limit for transition to retirement.

Apprentice & Trainee Scheme

- The boosting apprenticeship wages subsidy has been extended again. This will apply to apprentices and trainees who are hired between now and 30 June 2022. Employers are eligible for a rebate of 50% of the apprentices wages up to a maximum of $7k per quarter for the first 12 months of the apprenticeship. The current scheme also includes 10% of wages for the 2nd year of the apprenticeship capped at $1,500 per quarter and 5% for the 3rd year capped at $750 per quarter.

- Remember your existing apprentices are already qualified so you will continue to claim those wages rebates each Quarter.

- Apprentices will also receive $1,250 in Training Support Payments every 6 months for 2 years. This will commence post 1 July 2022 and will be for apprentices in “priority” occupations.

- From 1 July 2022, the existing boosting apprentice’s wage subsidy will be replaced with a new apprentice wage subsidy. It will only be available to employers of apprentices in “priority” occupations and will cover 10% of the wages for first and second year apprentices, and 5% for third year apprentices.

- Employers of apprentices in non-priority occupations will receive a one-off payment of $3,500 upon hiring the apprentice.

- Currently, the priority occupations are age care, childcare, disability care and nursing.

For more information or if you have any questions about your personal situation, contact our office on (08) 8172 9150 or email our friendly team today!